An S-Corp Gift

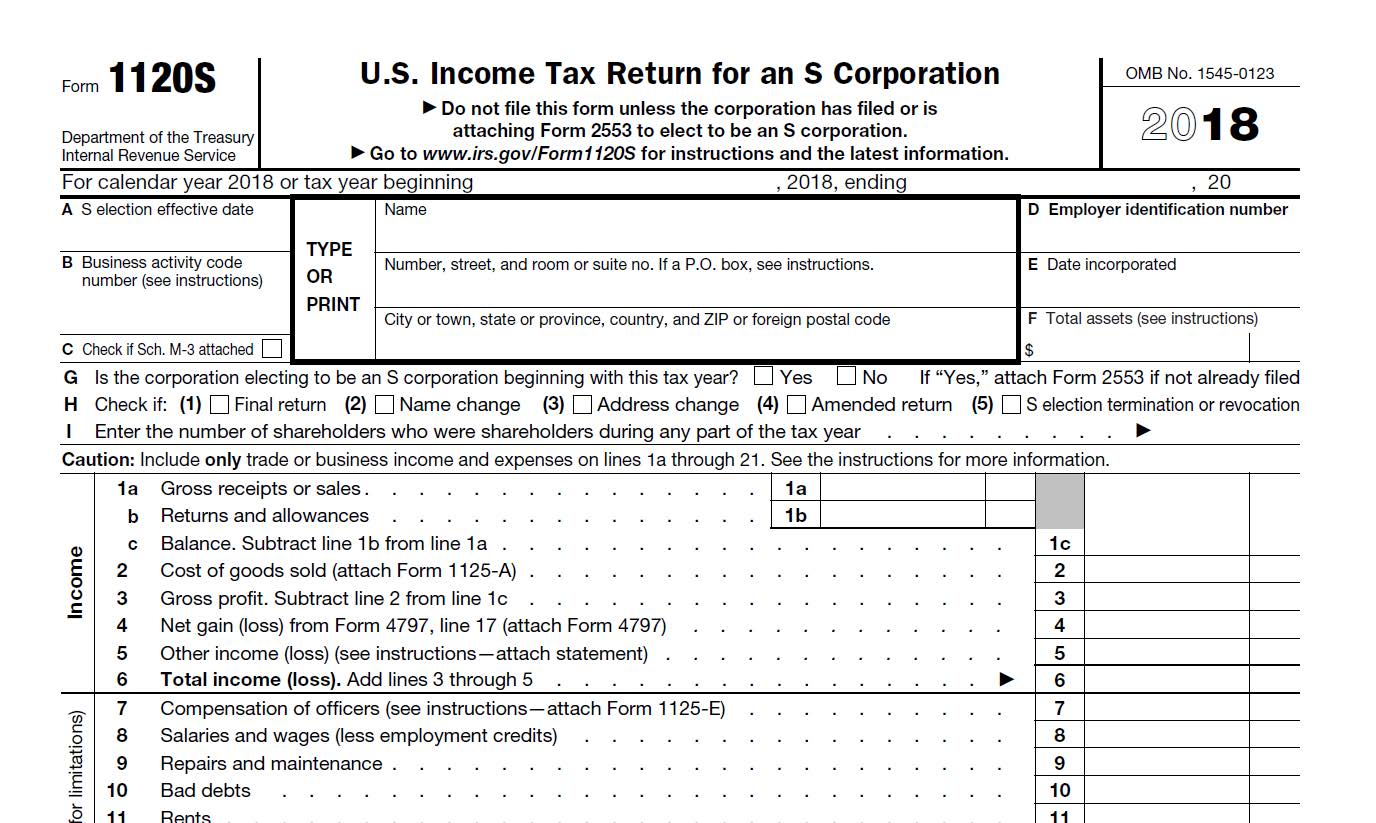

There are more S-corps than C-corps and LLCs combined – but very few donations are occurring. With S-corps, there are subtle nuances that must be considered, not the least of which include the issue of unrelated taxable income (UBTI) on profits earned (pre and post contribution gain) as well as any income during the holding period.

There are more S-corps than C-corps and LLCs combined – but very few donations are occurring. With S-corps, there are subtle nuances that must be considered, not the least of which include the issue of unrelated taxable income (UBTI) on profits earned (pre and post contribution gain) as well as any income during the holding period.

S-corporations pass the tax responsibilities to their shareholders, so like members of an LLC, the shareholders are individually responsible for the tax burdens of the business.

In the Spring of this year Charitable Solutions (CS) was approached by a senior planned giving officer at a large community foundation about a potential S corporation gift. The S-corporation had two shareholders, a husband and wife, and a potential buyer to whom they expected the business to sell within a few months.

We connected with the donors and their advisors and talked through the various aspects of the S corporation transaction. The donors had a specific net dollar amount they wanted to donate and understood that the donation of S-corporation stock to the charities they wished to support would burden them with material tax liabilities in the form of unrelated business taxable income (UBTI). This meant that CS would have to work with the donors’ and their advisors to estimate the tax liability, so they could decide how much to donate.

Charitable Solutions manages a trust-form Donor Advised Fund, Dechomai Asset Trust (“DAT or the Charity”), which is located in an income tax-free state. However, under IRS regulations, the Charity is still liable for tax on income for each day it owns Subchapter S-stock and on the gain from the sale of that stock. In this case the gain on the sale of the shares constituted a larger liability than the tax on the income during the holding period.

Because the Charity is taxed as a trust under the IRC it is allowed a 60% federal charitable deduction for every dollar it grants to another charity. This reduces the effective rate on federal capital gains to 8% from 20% and on ordinary income to 14.8% from 37%. As a result of these tax savings the donors were able to claim a $1.25 million charitable income tax deduction – they actually increased their donation by 10% - while the Charity’s federal tax liability was limited to $100,000.

From first conversation to completed donation, the process took less than two weeks, the community foundation remained involved throughout the process and received the proceeds of the sale within four weeks of the initial conversation.

Charitable Solutions has successfully completed over $500 million of S-corporation donations and LLC interests for many charities using its experience of our uniquely structured Dechomai Asset Trust to reduce or eliminate the tax liabilities. Our fees range between 3 and 1% since inception in 2003 (the average is 1.8%). We can also receive S-corp stock for charitable gift annuities as a life-income alternative to a CRT.

Our 15-person firm exists to make gifts happen that otherwise wouldn’t. If we can help you or your clients/donors with S-corp donations (or any other illiquid asset for that matter) please give us a call. A link to the current line-up of Charitable Solutions' services and offerings is also provided for your files.